Employers are increasingly focused on the well-being of their employees and continue to introduce...

Physical Wellness is NOT Enough

TIME STAMP: 4 MINUTE READ

Wellness programs can be found in most companies throughout North America these days, yet too many corporate wellness programs focus solely on the physical wellbeing of employees. Gone are the days where a purely physical wellness program works. Together with physical wellness, mental and financial wellness all contribute to a complete wellness program that leads employees to be happier, healthier and more engaged than ever.

Wellness programs can be found in most companies throughout North America these days, yet too many corporate wellness programs focus solely on the physical wellbeing of employees. Gone are the days where a purely physical wellness program works. Together with physical wellness, mental and financial wellness all contribute to a complete wellness program that leads employees to be happier, healthier and more engaged than ever.

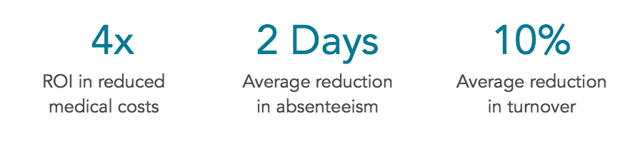

Workplace wellness programs can come at a cost, but if they are executed correctly then they have the potential to offset rising healthcare costs and build a healthier, motivated and more focused workforce.

To have a complete wellness program, financial and mental wellness need to be included as well. Here’s why:

Mental Wellness

According to the World Health Organization, as many as 450 million people worldwide suffer from a mental or behavioral disorder, and the average costs for employees with depression may be 4.2 times higher than those incurred by a typical employee. While mental health is not as easily measured as an employee’s blood pressure, it is still just as important. When an employee’s mental health is suffering, it can lead to more serious health problems. Even stress can be a silent killer.

Things like absenteeism, high turnover and loss of productivity are often signs that are linked to poor mental health. Employers can start to incorporate mental health into their wellness program by ensuring that employees have access to mental health benefits, as well as an employee assistance program. Employee Assistance Programs have proven to work well in a wellness program, as they provide referrals to mental health professionals while maintaining a high standard of confidentiality. Employers who provide mental health programs as a part of their workplace wellness program are proven to have an advantage over those who don’t in terms of lower incidents, staff turnover and workplace injury. Activities such as yoga, massages and meditation are an easy way to start bringing mental wellness into your overall wellness program.

Financial Wellness

Financial wellness can be categorised as having control over one’s finances, or the capacity to manage unexpected expenses or bills. Financial wellness programs offer employees the chance to better educate themselves on a variety of financial information that they would not bother to search for themselves or that may be stressing them out.

To provide an adequate financial wellness program, employers must provide resources that help short and long term financial goals. Financial planning for retirement is great, but what about next week’s bills? Employees with low financial confidence risk making bad financial decisions, or avoid making them at all, and as a result end up stressed and unhappy.

As with any wellness program, financial wellness programs need to be tailored specifically to the employee. Every employee’s financial situation will be different and will require a specific plan.

Any wellness program that is implemented within a company should incorporate all types of wellness in a more holistic approach. It is no longer beneficial to the employee or employer to miss one of these crucial elements out of their wellness program. Read more tips on how to avoid failing traditional approach to wellness programs.

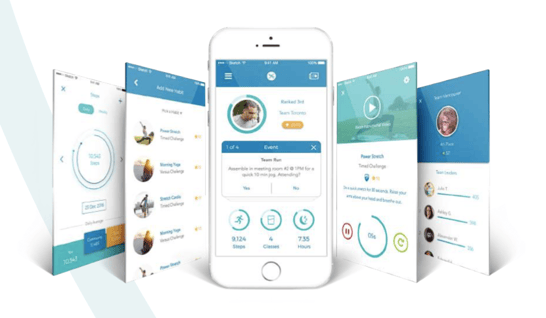

At Optimity, our customized holistic approach incorporates all aspect of health, by providing customized solution to wellness. Our approach garners positive results.

We help the average worker take productive 30 second to 2-minute micro-breaks that have long last beneficial impact. These micro-habits boosts their mood, helps them focus and encourage social connectedness to their culture. Optimity’s app provides users with tips on financial wellness, that way employees now have the tools to confidently make smart decisions about their finances.

Want to know more about how we can help you implement a personalized coaching program in your company? Reach out to us at engage@myOptimity.com and lets have a chat.